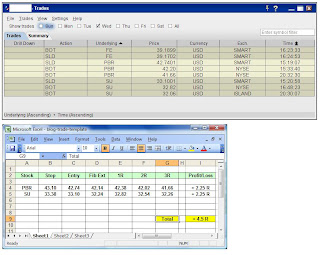

PBR (gap down)

Bearish first and fall below OR on 2nd. The 3rd was red hanging man NR bar and was our short trigger. An aggressive entry but market looked weak so it was worth the risk IMO. Fell nicely after entry as market weakened. Closed partial near the Fib Ext (around 1.5R) then rest was left to run. This was closed towards end of the day just past a $1 gain for 3R.

SU (gap down)

Bearish first and fall below OR on 2nd. The 3rd was red hanging man NR bar and was our short trigger. An aggressive entry but market looked weak so it was worth the risk IMO. It was showing some support near whole number, so closed partial at 1R. The rest was closed towards end of the day just past a $1 gain for around 3.5R.

The trade shown below on FE was a keying mistake on my excel api. So I closed it pronto as soon as I realised I had entered a position.

------Daily Stats ---------------------------

I mentioned a while back that I was rethinking my strategy. It is something I have been working on for a while now. At the moment I am not really fully utilising it, but more just observing and sometimes I do use it as extra confirmation for trade entry. The first thing to say is that this is not a major overhaul of how I am trading. It is more of a refinement in an attempt to stay out of potential bad trades. I am still using OR breakouts, trend pullbacks , NR bars etc etc.

What I will do is post my ideas and thinking in a separate post in the next day or so. Hopefully some readers will provide feedback on their views of what I plan to do and maybe it is something you guys have tried yourselves or are using now. As a quick taster it involves using CCI divergence on the DOW index to drive entries in stocks. Also using comparative relative strength as an additional confirmation signal. It may sound complicated but it isn't really. If you don't know about divergences or about CCI then have a quick scan on the web to get some basics and you will be up to speed.

4 comments:

nice trades, AM.

I use prophet.net to scan gaps but today it did not pick up PBR and SU. looks like prophet does not work well. What do you use to scan gaps? Thanks

Song

IB and Tradestation.

another good week... golf on Friday???? :)

Question about CCI, are you using the indicator solely with the DOW price action or are you applying it to the individual stocks. What period and signal values are you using?

OOnr7.

Would love to play golf on Friday, but other things to do.

CCI > Using only on DOW not on stocks. Period=6, Signal=5

Post a Comment