This was a relative strength trade. Initial price action was weak compared to very strong market. The 3rd is closing below OR and still room to run to ema. This is our short trigger.

Moved stop to breakeven at 1R then closed position at $1 gain as stock began to recover.

I did have some orders in for longs (BBY,LLTC) but they never triggered.

Market closed tomorrow and I'm also away for next few days or so as Monday is a public holiday in UK. So depending on when I come back I may not trade on Monday or Tuesday. However I should be back trading on Wednesday. Hope you had a good day and enjoy your holidays.

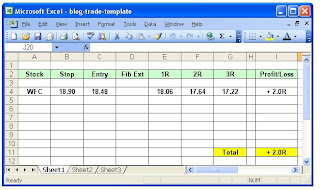

--------Fib and RValues-------------------

-----------Trades--------------------------

9 comments:

Nice trade! Congrats!

AM,

Have you done any studies to see what your results look like if you had taken 1/4 or 1/3 off at 1R and then left the rest? Possibly taking another partial at another target and letting the rest go to EOD.

I am really getting into R and Expectancy and was wondering about your method. I know you do a lot of testing/spreadsheets, etc. and was wondering how different profit objectives compare.

Thanks,

Tyler

Day Tradr...Thanks

Tyler.

I did some studies a while back on taking partials. Mostly based on two part position size though. So exiting in two phases.

I also did do some research with 1/3 position sizes. Taking 1/3rd at 1R, another 1/3rd at 2R and rest at eod. But found that it didn't provide much more benefit than the 1/2 and 1/2 route.

Thanks

AM,

Thanks! I appreciate it.

Tyler

As good as your are with analyzing 15 min chart, any particular reasons you do not trade 30 min charts? It seems most of your trades are before 12.00pm. Therefore, I am thinking that perhaps this might be the reason? Or still maybe your risk/reward is better when backtesting 15 min versus 30 min?

Anyways, any light you can shed on the matter would be greatly appreciated. Nice blog, BTW.

Thanks

Josh.

The 15mins suits my style of trading. I did look at 30mins briefly, but didn't really take to it. No other reason other than just finding a timeframe that I am comfortable with.

Thanks.

nice exit between the old Trader X standard 38.2% & .50% fibbo retrace level (PDL to ORH range retrace). Have a nice holiday Trader AM.

Hi TraderAm, I read in your previous post from Jan 09, you risk a maximum of .5% of capital per trade. Are you still at this % risk, or did you increased it now that you have more winning trades, and several months of successful trading behind you? Thanks

Post a Comment